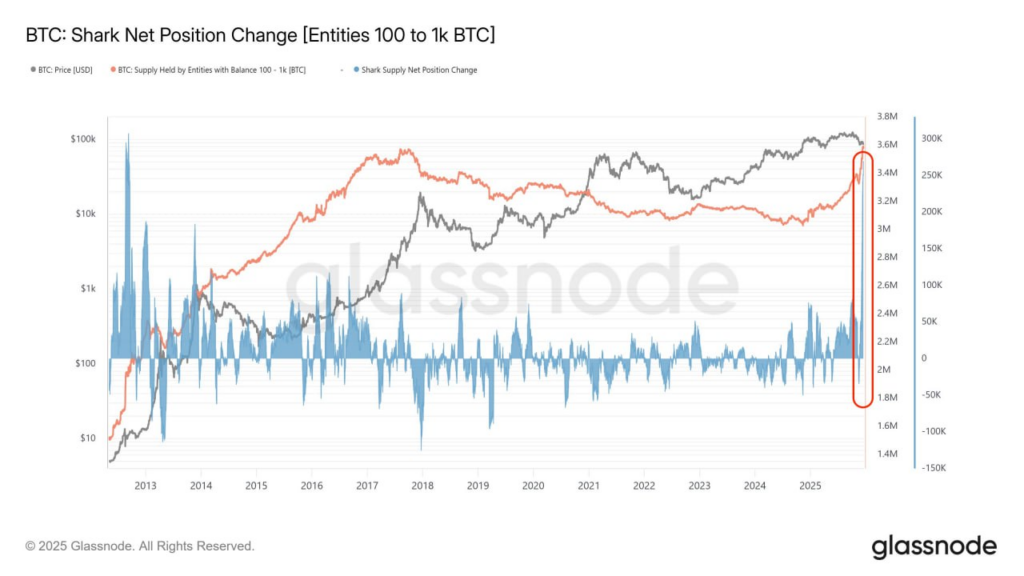

- Glassnode data shows sharks (100–1,000 BTC holders) accumulated nearly 270,000 BTC worth $23B in the past month, the largest such move in years.

- Bitcoin’s weekly RSI has fallen to levels last seen at major bear-market bottoms, yet similar setups previously preceded deeper 40–50% drawdowns.

- While mid-sized whales are accumulating aggressively, long-term holder supply continues to decline, suggesting distribution isn’t fully complete.

Bitcoin price is currently trading around $87,000 as of December 18, 2025, down sharply from its October all-time high of over $126,000. The cryptocurrency has fallen nearly 30% in recent months, reflecting a broader market correction.

Despite the fall in Bitcoin price, Glassnodedata shows signs of renewed buying by large holders. Whales (entities holding 100 to 1,000 BTC) have accumulated hundreds of thousands of BTC in recent weeks, including reports of nearly 270,000 BTC worth $23 billion added in the last 30 days.

A key Glassnode chart that tracks “Shark” entities (100-1,000 BTC) shows their supply held (orange line) has risen steadily to over 3.4 million BTC, while net position change (blue bars) shows a sharp recent increase. This suggests sharks are buying the dip aggressively, the largest such move in years.

However, not all whales agree. Some larger holders have sold, and the long-term holder (LTH) supply has dropped to around 14.3 million BTC, down from 14.8 million earlier in 2025 after heavy distribution in October.

Bitcoin Price Analysis Shows Caution

The BTCUSDT weekly chart reveals the Bitcoin price action since 2019. BTC peaked near $126,000 in late 2025 but has since corrected, with notable drawdowns marked: -49.82%, -36.66%, and -58.93% in past cycles.

The lower panel highlights an oscillator at 37.64, shows the weekly Relative Strength Index (RSI), now at oversold levels not seen since major bear market bottoms like 2018-2019, the 2020 COVID crash, and 2022.

Analysts warn that past oversold readings led to further drops of 40-50% before recovery. Bottoms can take time and bring more pain.

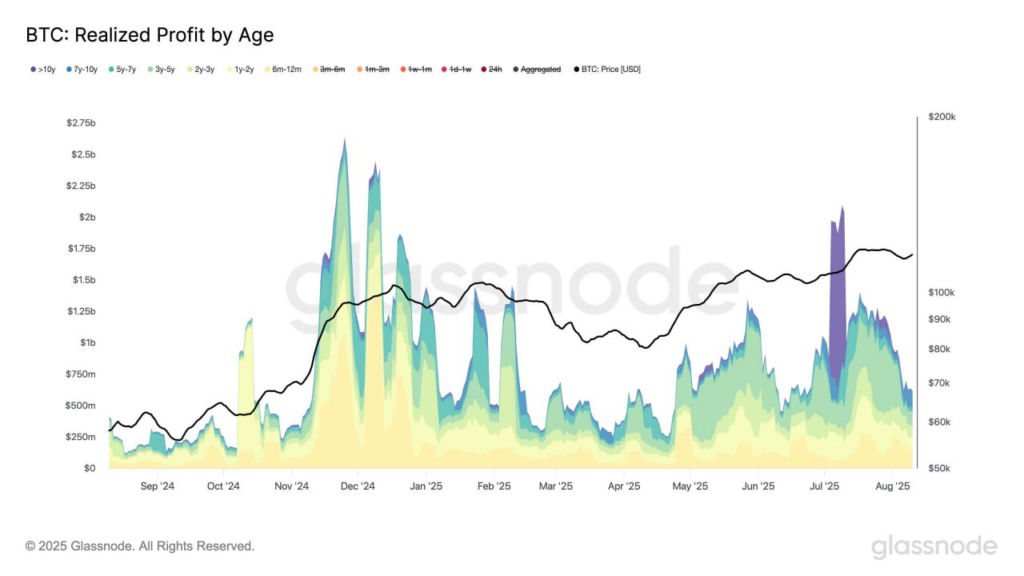

Meanwhile, another Glassnode chart on realized profits by holding period shows older coins (green/yellow bands) dominating profits earlier in 2025.

Recent activity shifts to shorter-term holders, with aggregated profits (black line) declining alongside price (right axis around $60k-$100k). This indicates profit-taking by newer buyers during the pullback.

Betting markets like Polymarket favor Kevin Hassett at over 50% to be Trump’s next Fed Chair nominee, ahead of Christopher Waller (around 22%) and Kevin Warsh (lower). A more dovish Fed could support risk assets like Bitcoin, but no announcement has been confirmed yet.

Bottom Line

Overall, on-chain data points to whale buying as a potential floor, but oversold RSI and historical patterns suggest the correction may not be over. Investors watch for sustained accumulation or a break below key supports.

What’s your Reaction?

+1

1

+1

0

+1

0

+1

0

+1

0

+1

0

+1

0